unrealized capital gains tax bill

Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

Unrealized capital gains tax bill Thursday March 10 2022 Edit.

. To increase their effective tax rate. Mitt Romney R-Utah told. Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIsthe Elon Musks and Mark Zuckerbergs.

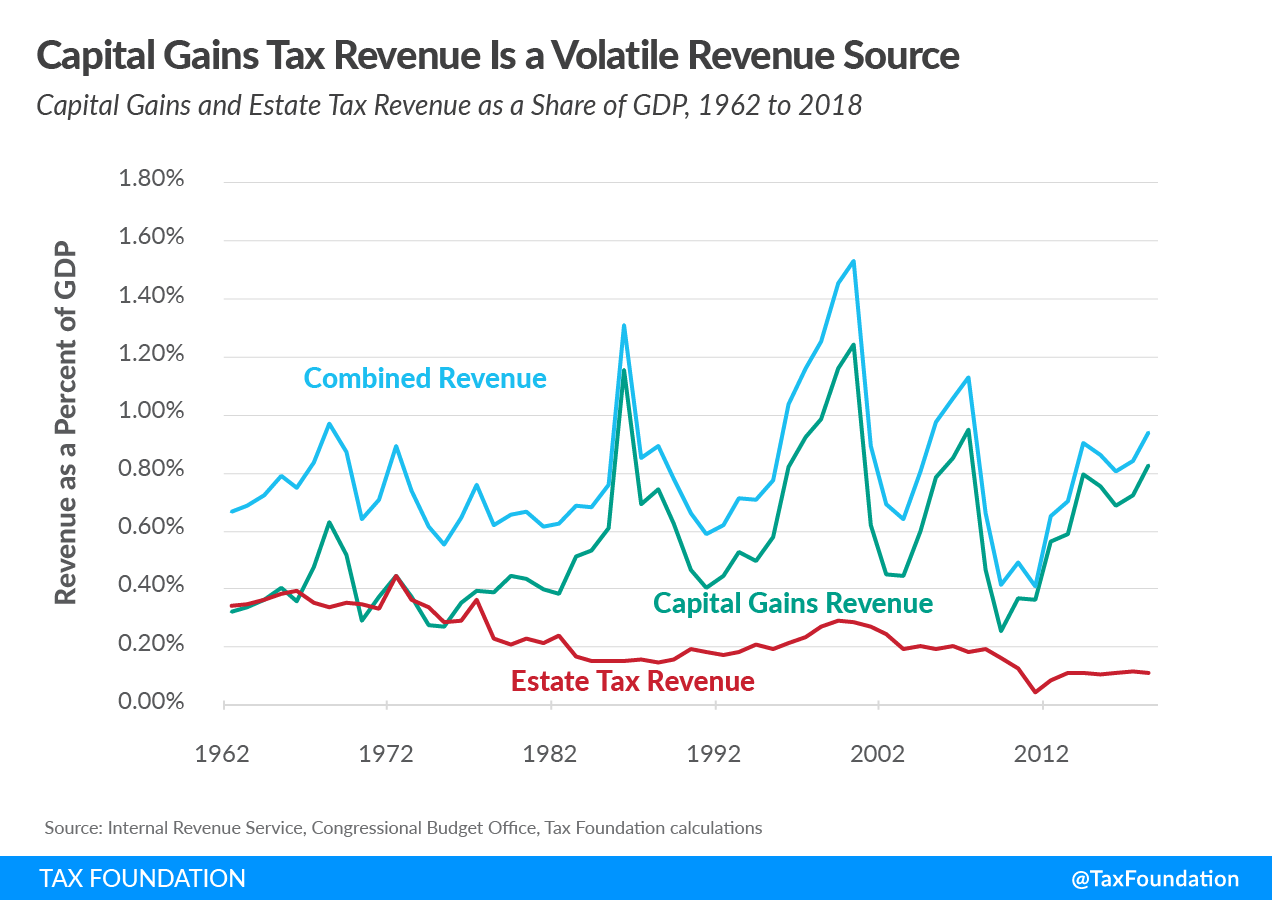

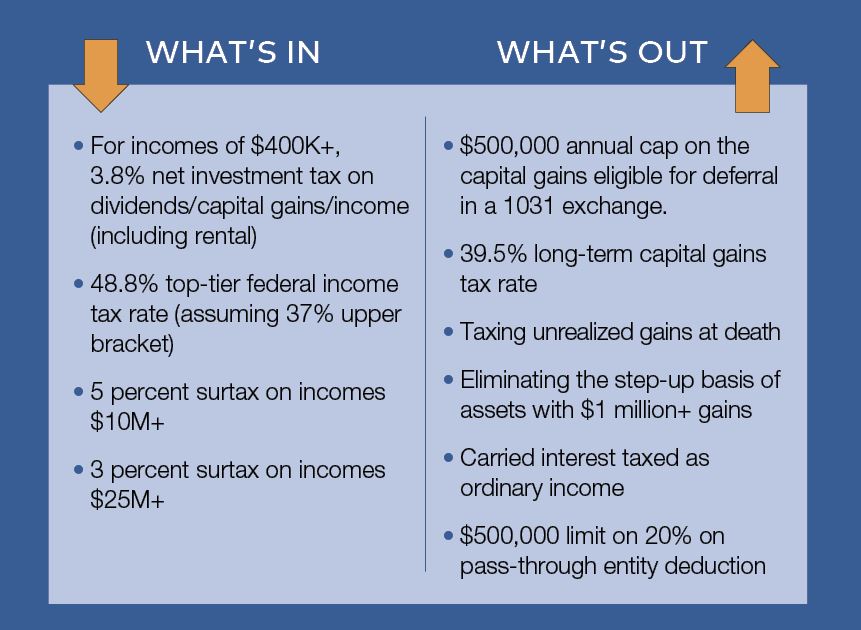

A tax on unrealized gains would harm the economy. Biden again called to raise the corporate rate to 28 from 21. As the WSJ explains this new unrealized capital gains tax would look at the value of the asset on January 1 and.

The Proposal adds a 20 minimum tax on the unrealized capital gains for households worth at least 100 million. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation. We probably will have a wealth.

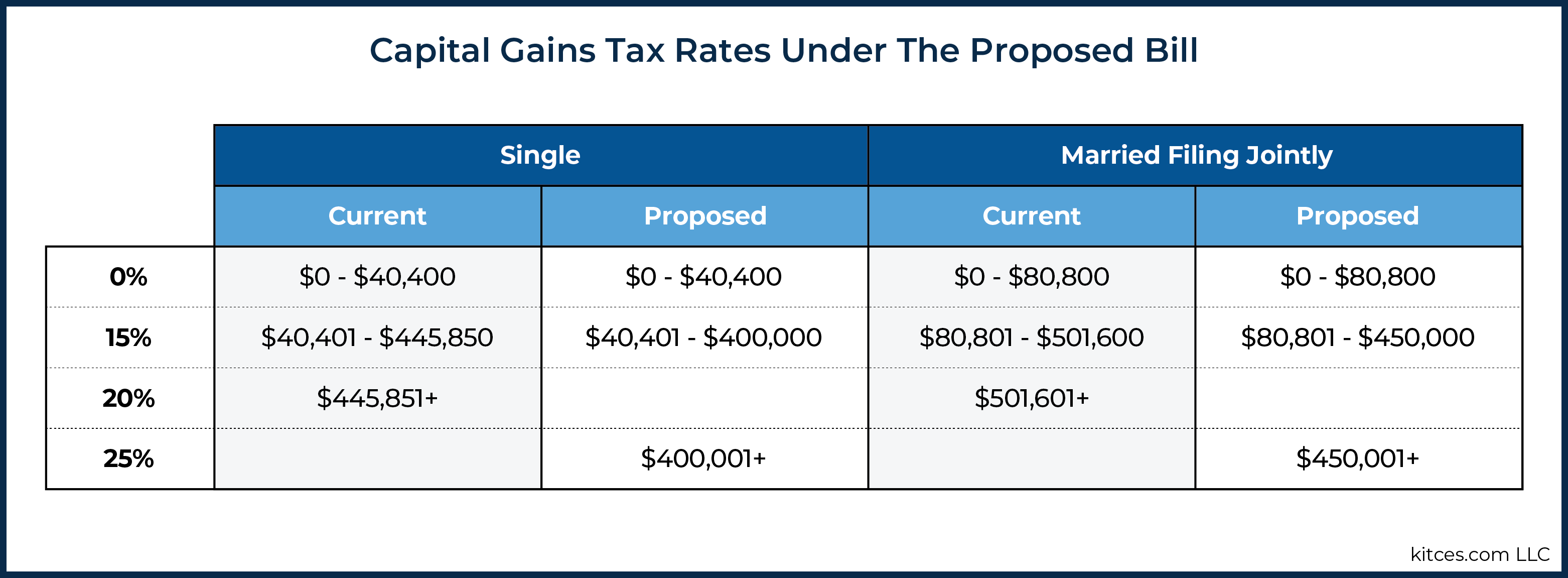

The idea is that for billionaires only annual gains in wealth would be treated as income. So under current law someone whose net worth rose to 22 billion from 20 billion. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation. Under the proposed Billionaire. Even though reports suggest the proposed.

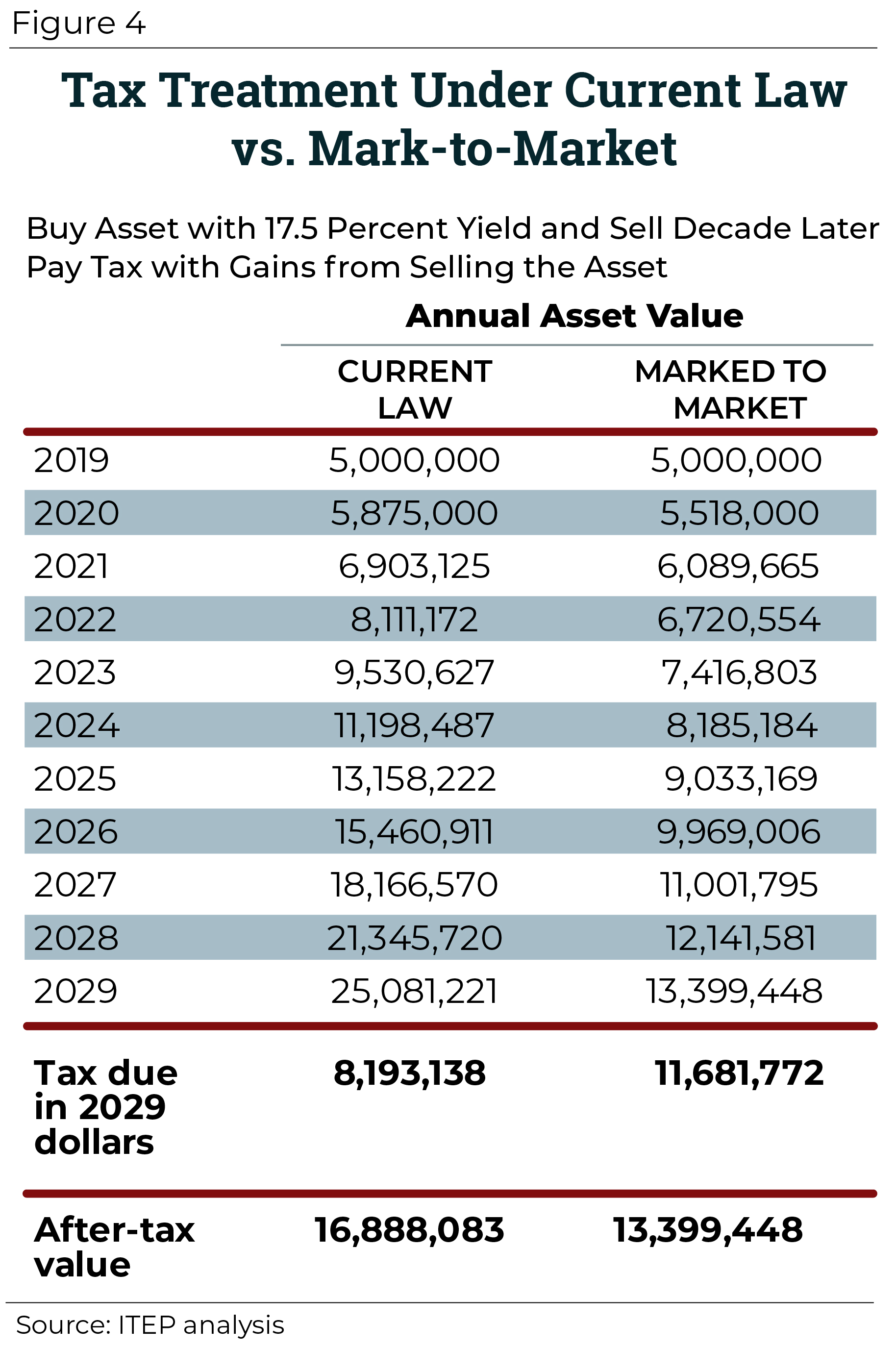

In other words they want to tax billionaires unrealized not sold yet capital. Prohibiting Unrealized Capital Gains Taxation Act. The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains.

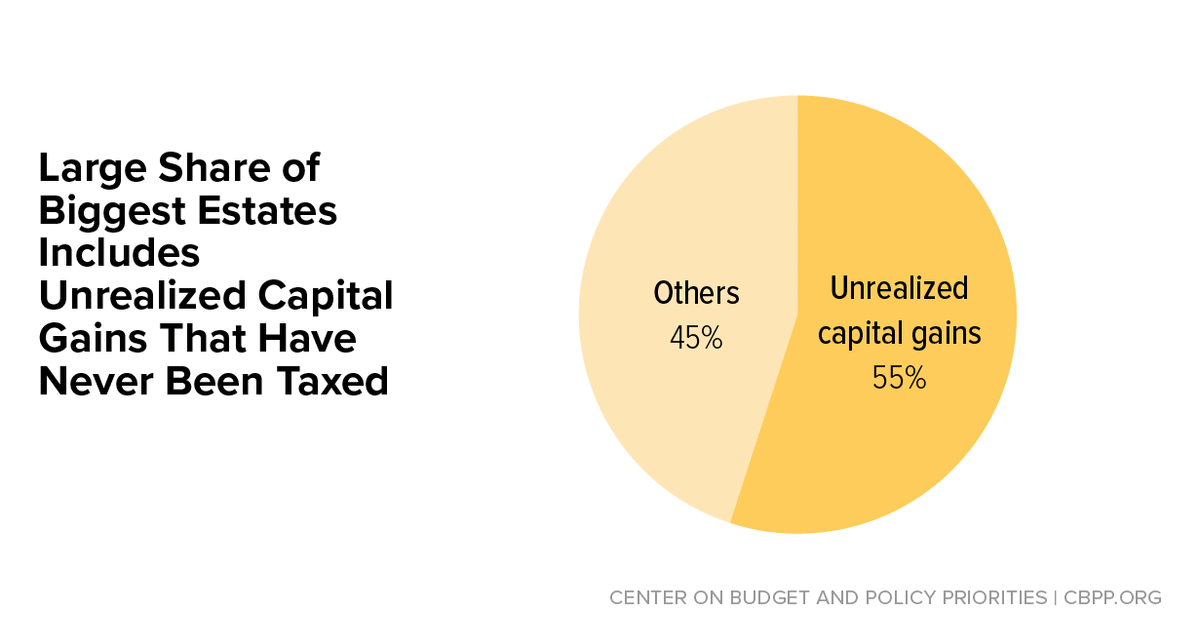

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring. The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years.

Text for HR5814 - 117th Congress 2021-2022. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. The largest part of the tax bill will be upfront.

Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving. WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital. Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social.

Introduced in House 11022021 Prohibiting Unrealized Capital Gains Taxation Act. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. This bill prohibits the Department of the Treasury or any other federal.

If you hold an asset for less than one year and sell for a capital gain the. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized.

The Problems With an Unrealized Capital Gains Tax.

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas

The Billionaire Minimum Income Tax Is A Tax On Unrealized Capital Gains Coming Ramseysolutions Com

What Is Unrealized Gain Or Loss And Is It Taxed

What Are Capital Gains Taxes And How Could They Be Reformed

Epic Games Tim Sweeney Says Democrats Unrealized Capital Gains Tax On Billionaires Would Crush Entrepreneurs Fox Business

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Taxes Bitcoin News

Democrats Unveil Plan To Tax Unrealized Capital Gains

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Analyzing Biden S New American Families Plan Tax Proposal

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

How Elon Musk Could Pay For A Tax On Unrealized Capital Gains Barron S

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)